FICO scoring

What’s in FICO Scoring?

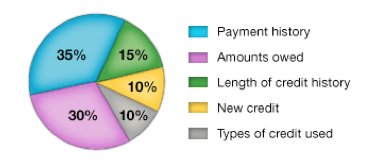

FICO Scores are calculated from a lot of different credit data in your credit report. This data can be grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining your FICO score.

What’s NOT in FICO Scoring

FICO scores consider a wide range of information on your credit report. However, they do not consider:

- Your race, color, religion, national origin, sex and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

- Your age.

Other types of scores may consider your age, but FICO scores don’t.

- Your salary, occupation, title, employer, date employed or employment history. Lenders may consider this information, however, as may other types of scores.

- Where you live.

- Any interest rate being charged on a particular credit card or other account.

- Any items reported as child/family support obligations or rental agreements.

- Certain types of inquiries (requests for your credit report).

The score does not count “consumer-initiated” inquiries – requests you have made for your credit report, in order to check it. It also does not count “promotional inquiries” – requests made by lenders in order to make you a “pre-approved” credit offer – or “administrative inquiries” – requests made by lenders to review your account with them. Requests that are marked as coming from employers are not counted either.

- Any information not found in your credit report.

- Any information that is not proven to be predictive of future credit performance.

- Whether or not you are participating in a credit counseling of any kind.